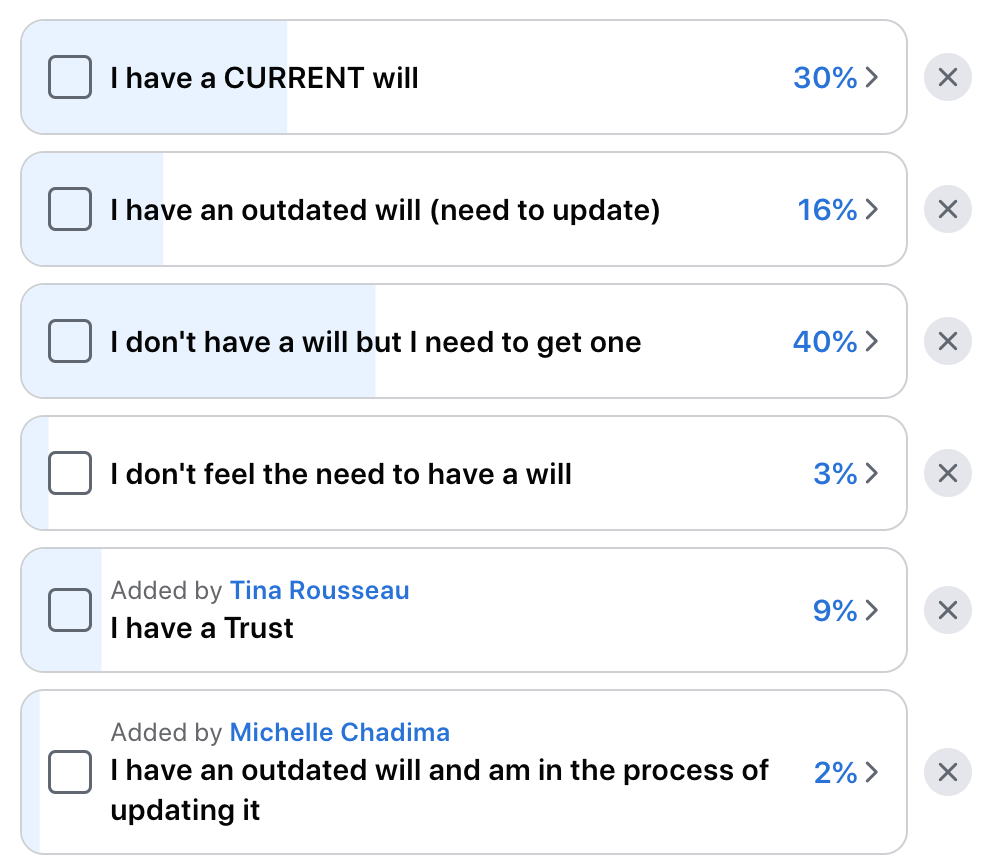

A few days ago I posed a poll question in my Facebook group and the answer was pretty surprising for a group of preparedness minded individuals. Here is what they had to say when asked if they have a current will or trust:

Estate planning has been on my mind a lot lately because I’ve had a few friends go through some pretty terrible things and it made me want to get my own affairs in order. I have a blended family and my kids’ dad is a pilot so if something were to happen to me, it isn’t just an easy answer as to who would take care of them. I was talking with my kids about it and they all had different opinions of what they wanted to have happen. My sweet eleven year old daughter said that my current husband could probably still take care of them because “HE WOULD STILL BE OUR STEP DAD!” But would the courts allow that to happen? Would their dad? I don’t know!

Do You Need a Will or a Trust? {{VIDEO}}

Establish a Living Will

Having a living will allows you to decide whether or not you want to remain on artificial life support when there is no chance of recovery. It relieves your family of the burden of having to make that decision. A living will doesn’t necessarily include a DNR (do not resuscitate) directive. That is usually established with the help of a doctor from my understanding. A living will can also establish a medical power of attorney (POA) and a financial power of attorney.

Medical POA: This will allow someone to make decisions in regards to your healthcare should you become mentally incapacitated and unable to adequately determine what is best for your own care.

Financial (Durable) POA: This will allow someone to manage your financial decisions, write checks for you, and generally manage your legal affairs.

In most states, the forms will have to be signed in the presence of two witnesses and/or a notary public. You must also be of sound mind and be able to sign the document out of your own free will.

RESOURCES:

Free Medical POA and Living Will forms

Free Financial (Durable) POA form

LEGAL ZOOM Living Will ($49) – reviewed by a lawyer

Create a Last Will and Testament

Without a will, the courts will decide what happens to your children and your assets should you pass away unexpectedly. It gives you and your loved one’s peace of mind and security, knowing you have made the decisions for where your belongings go. This will also help avoid arguments over assets and property. Your will should include the following items:

- Nominate a guardian for any children you have

- List your assets and how you want them distributed

- Name an executor of your estate to take care of fulfilling your wishes

Life insurance policies take precedence over a will so make sure to adjust those policies accordingly or your finances may not be distributed as you intended. Your will should be reviewed each year and kept in multiple places so that your family can easily find it should something happen to you.

Most states require 2 witnesses to sign your will to make it legal and valid. In some states, it is necessary to sign with a notary public.

RESOURCES:

Free Will Templates

LEGALZOOM Comprehensive Will ($99) – reviewed by a lawyer

Living Trust (if necessary)

A trust is used to distribute your assets without the use of courts or attorneys. It serves much of the same function as a will but with less hassle and heirs can have access to the assets immediately instead of waiting to go through probate. There are less tax ramifications by using a trust and it is just a much smoother process. You will want to include a “pour-over” will that will automatically put anything into the trust that was still in your personal name when you die. But it is best if you just review your assets each year and make sure to add them into the trust.

Trusts are a little more complex, especially if you have a lot of assets or a complicated situation with dependents. I would recommend getting legal advice before doing too much with this.

RESOURCES:

Free Living Trust Form

LEGALZOOM – Living Trust ($299) – reviewed by a lawyer

Estate Planning Bundle

I have been going through all of the free templates with my husband and hashing out a lot of our decisions on these things. However, I feel like for something so important I would like to get legal council and make sure that it is done properly so that our children or parents aren’t left with a mess if something were to happen to us.

I LOVE the idea of the LEGALZOOM Estate Planning Bundle. It is $449 and includes a trust for the two of us, two living wills, and two power of attorneys. I think it should be everything we need and at a fraction of the cost of going to a personal lawyer. If you’re interested in hearing more about my experience with this make sure to follow me on InstaGram as I will do more behind the scenes updates over there.

If you have a more complicated situation I have someone I can refer you to who can help with more complex planning, it will just be more expensive.

Do you need a will or trust?

Pin this post to save for later!

-Jodi Weiss Schroeder

http://foodstoragemadeeasy.net