Welcome to the 7 Day Challenge. For 7 days, we are testing our Emergency Preparedness and Food Storage Plans. Each day will bring a NEW mock emergency, or situation that will test at least one of the reasons “WHY” we strive to be prepared! REMEMBER: No going to a store, or spending any money for the entire 7 days! And please feel free to adapt the scenarios to fit your own family and situation.

Today’s challenge is for you to consider what would happen should you and/or your spouse pass away. This is something we don’t like talking about (or preparing for), however it’s VERY important. There’s no way to put this lightly – but do you have your affairs in order should something happen to you? We are always trying to prepare for natural disaster situations, and sometimes people don’t survive these scenarios. What would happen if you didn’t make it but the rest of your family did?

Today’s Goal: Get your legal/financial affairs in order in case you die

Today’s Tasks:

- Prepare a draft for a will if you don’t have one already

- Make a list of all your assets for those you leave behind

- If you have children, develop a plan for who will take care of them if you and your spouse passed away

- Make lists of all the other things you would need/want surviving family to know

- BONUS: If one spouse normally handles the bills/finances in the family, have the OTHER spouse fill out this little questionnaire to find out what he/she knows about your family’s financials and how to access important family account information

Today’s Limitations:

- For this day, and ALL days of the challenge: no spending money, no going to stores, and no restaurants.

- Since this is a planning day, there are no other limitations

Advanced Tasks:

- Please note: These advanced tasks may take days or weeks of planning and consulting with your professional accountants and insurance agents.

- Put together your emergency binder if you don’t already have one (this is a great starting point).

- Create an actual PLAN ON PAPER for whomever you choose to be your children’s guardian (include specific care instructions, information to access life insurance policies, instructions where to find important documents for the kids, etc.)

- Whoever does the bills in the family, put together a master list of online account information, auto-pays that come out of your account, amounts in each account, investments and insurance policies and how to access them, etc. Anything your spouse would NEED to know if you weren’t around.

- Research life insurance options if you don’t have any yet.

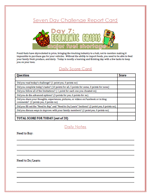

Make sure your fill out today’s Report Card to see how well you did, to keep track of areas you can improve, to remember things you need to do, and things you need to buy. Use the data to make a game plan to take you to the next level of preparedness, whatever that may be.

Make sure your fill out today’s Report Card to see how well you did, to keep track of areas you can improve, to remember things you need to do, and things you need to buy. Use the data to make a game plan to take you to the next level of preparedness, whatever that may be.

-Jodi Weiss Schroeder

http://foodstoragemadeeasy.net